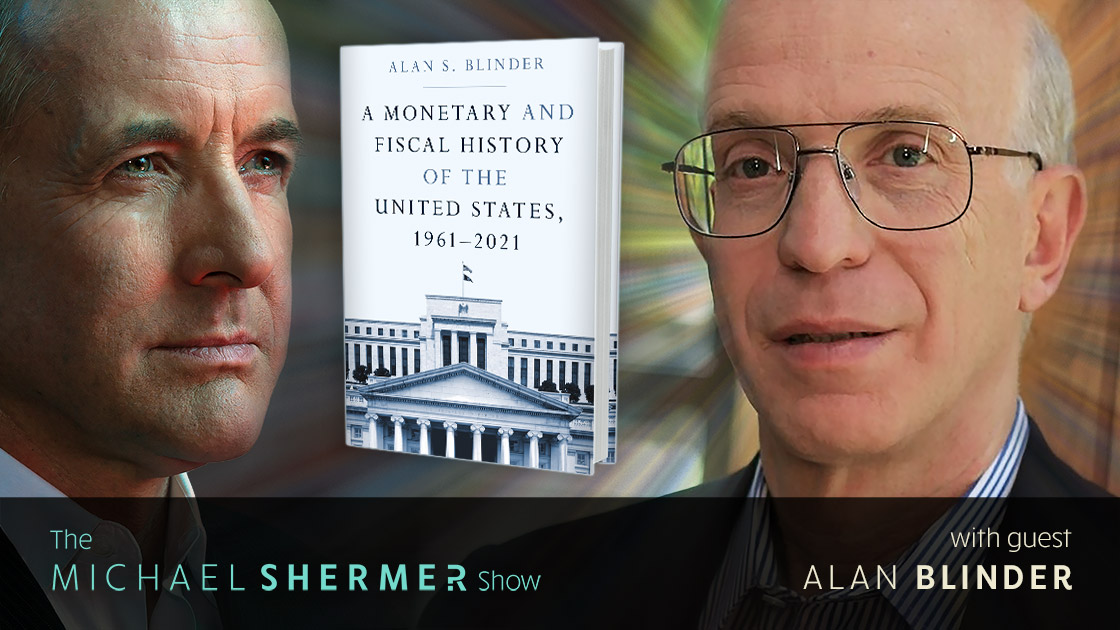

Shermer and Blinder discuss:

- what it was like to serve on Bill Clinton’s Council of Economic Advisers

- what it was like to be the Vice Chair of the Federal Reserve Board

- What kind of science is economics?

- Why would one’s political leanings influence cause-and-effect economic theories?

- the difference between monetary and fiscal policy

- What is a Keynesian approach to economics?

- inflation and stagflation

- recessions, depressions, Bull and Bear markets defined

- interest rates

- the Federal Reserve

- the money supply

- What makes money valuable without the gold standard?

- how the government can give billions of dollars in COVID relief and other programs (e.g., American Reinvestment and Recovery Act, Economic Stimulus Act of 2008, Emergency Economic Stabilization Act of 2008, Paycheck Protection Program, etc.)

- What does a “balanced budget” mean in today’s economy?

- aggregate demand and supply

- deficit spending

- business cycles/boom-and-bust cycles

- Reagonomics/trickle-down economics

- Is GDP the best measure of an economy’s success?

- unemployment and full employment: what’s the right percentage?

- income tax: what’s the right percentage?

- the best investments to make in the long run

- modern monetary theory, and

- utility maximizing.

Alan S. Blinder is the Gordon S. Rentschler Memorial Professor of Economics and Public Affairs at Princeton University, a former vice chair of the Federal Reserve Board, and a former member of the President’s Council of Economic Advisers. A regular columnist for the Wall Street Journal, he is the author of many books, including the New York Times bestseller After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead. He lives in Princeton, New Jersey.

About the Book

Alan Blinder, one of the world’s most influential economists and one of the field’s best writers, draws on his deep firsthand experience to provide an authoritative account of sixty years of monetary and fiscal policy in the United States. Spanning twelve presidents, from John F. Kennedy to Joe Biden, and eight Federal Reserve chairs, from William McChesney Martin to Jerome Powell, this is an insider’s story of macroeconomic policy that hasn’t been told before.

Focusing on the most significant developments and long-term changes, Blinder traces the highs and lows of monetary and fiscal policy, which have by turns cooperated and clashed through many recessions and several long booms over the past six decades. From the fiscal policy of Kennedy’s New Frontier to Biden’s responses to the pandemic, the book takes readers through the stagflation of the 1970s, the conquest of inflation under Jimmy Carter and Paul Volcker, the rise of Reaganomics, and the bubbles of the 2000s before bringing the story up through recent events — including the financial crisis, the Great Recession, and monetary policy during COVID-19.

If you enjoy the podcast, please show your support by making a $5 or $10 monthly donation.

This episode is sponsored by Wondrium:

This episode was released on October 11, 2022.