The oil crises of 1973 and 1979 shocked us into realizing that oil is a scarce commodity, its supply can be manipulated, and the price can rise suddenly and so can inflict “pain at the pump.” However, after each oil crisis briefly induces people to drive less and conserve energy for a while, the price eventually falls, and automakers again offer big gas guzzlers while smaller, fuel-efficient cars don’t sell as well.

Then, starting in the late 1990s, oil prices increased, with the price of a barrel of oil rising from $30 in mid-2003 to $60 by August 2005, which then climbed steeply to an all-time record of $147 by July 2008. This real oil crisis has no single, simple cause the way the 1973 OPEC embargo or the Iran-Iraq turmoil of 1979 produced temporary disruptions. Rather, the real effects of declining petroleum reserves are being felt as China and India demand more oil for their rapidly growing economies. Short-term events such as the 2006 Israel-Lebanon conflict, the Iranian nuclear buildup, Hurricane Katrina’s disruption of oil production in the Gulf of Mexico in 2005, and other factors like the 2020 economic slowdown due to the COVID-19 pandemic, caused spikes or crashes in the prices, but even after the effects of such events end, price still keeps climbing. Only a global recession, triggered by excessive speculation on overpriced real estate and too many people being given mortgages they could not afford on these same overpriced houses, pushed down oil demand, and the price retreated (although still nowhere near 1973 or 1979 levels).

The long-term effect is gradual, so we don’t see the gas station lines in the U.S. now the way we did in the 1970s (although they do occur in China), yet as the price at the pump reaches painful levels above $4 a gallon, people start to conserve again. As of this writing, gas is selling for over $5 a gallon in California.

To understand what may lie in the future, let’s start from the beginning.

The Origin of Oil

What is oil? How is it found and produced? Contrary to popular myth, oil is not produced from the bodies of long-dead dinosaurs. Rather, it is organic material that is formed by the decomposition of trillions of marine plankton as they became buried in sediments.1 Oil is actually a mixture of many different kinds of complex organic molecules, mostly long chains of carbon atoms with hydrogen atoms attached, or hydrocarbons. Chemically, oil is about 85 percent hydrogen and 13 percent carbon, with minor amounts of sulfur, nitrogen, and oxygen. The simplest of these hydrocarbons is methane (CH4), which is the major component of natural gas, along with longer-chain molecules like ethane (C2H6), propane (C3H8), and butane (C4H10).

These organic molecules start out as kerogen, a complex mixture of decayed organic matter in sedimentary rocks. The most common source of kerogen is deep-water shales, which often trap lots of decaying matter and are formed where there is not much oxygen to break it down. Rocks rich in kerogen are known as source rocks.

However, most source rocks are highly impermeable shales, so there is no point in drilling them directly. In addition, the kerogens in them are not yet oil when they first form. Instead, the kerogens must be cooked under pressure to break down into simpler liquid hydrocarbons we know as petroleum. These restrictive conditions greatly limit which rocks will produce oil and which ones will not. Under a normal geothermal gradient, the source rock must be buried about 2500 m (8000 feet) in the Earth’s crust, where the temperatures are at least 65°C (150°F) so the kerogen will break down into liquid petroleum. If they are buried too deep (greater than 4600 m or 18,000 feet), they will be heated too much (above 150°C or about 350°F), and the kerogen will break down into natural gas. We call this narrow range of suitable depths and pressures the “oil window.” The vast majority of the organic-rich rocks of the world have not resided in that range of ideal conditions long enough to produce oil. Time is also a critical factor. The kerogens must remain in the oil window long enough for oil to be produced, but not too long or they will be overcooked and break down.

If all the conditions are right for the source rock to remain within the oil window, liquid oil will be produced and then migrate out of the source rock to a reservoir rock, which has high porosity. This means oil can saturate it. Contrary to popular myth, a “reservoir” is not some big underground cavern full of oil. Rather, it is a solid rock with a high volume of porosity between the grains (sometimes up to 40 percent pore space in sandstones), and high permeability (interconnectedness between the pore spaces that allows the fluid to flow through).2 Typically, these are well-sorted (i.e., same-sized sand grains) quartz sandstones. They have lots of pores, with no fine clay or silt to clog them. Other rocks, such as limestones or granitic rocks, have no natural pores, but if they are fractured, they can develop high porosity and permeability along the fractures. Once the oil migrates from the source rock to the reservoir rock, a third condition is essential: an impermeable seal on top of the reservoir rock to trap the oil and prevent it from migrating further upward. The trapped oil then stays in the reservoir rock until drilling releases it.

Thus, the ideal conditions to produce oil—abundant source rocks cooked for a long time in the narrow oil window, with a good reservoir above the source with a seal on top—are really rare. This is one of the many reasons petroleum is actually quite scarce in most crustal rocks, and also why it is so difficult to find and obtain. There are far more rocks below our feet that might be good for producing oil but didn’t meet all these conditions: source rocks that never reached the oil window or were too heated; source rocks with no reservoir rocks above them; potential reservoir rocks with no seal above them; and so on. Vast quantities of oil have been generated in the geologic past, and even trapped, only to be destroyed by tectonics and erosion.

Oil geology is a risky business. Most promising prospects turn out not to have economical deposits of oil in them, and most holes that are drilled come up dry.3 Yet all that is needed is one really good producing well out of dozens of dry holes, and the payoff may be enough to keep them going, even when it costs over $2 million or more to drill a typical hole and $15 million for an offshore well.

The Draugen offshore drilling rig in the Norwegian Sea was initially developed with five subsea wells connected to a central platform. It costs about $15 million for an offshore well.

Given that oil is naturally scarce, the problems with the global oil supply now make a lot more sense. In addition, petroleum is not found everywhere, but most of the proven reserves are in just a handful of countries, most of which are members of the Organization of Oil Exporting Countries (OPEC). The major producers are in the Persian Gulf and Middle East (especially Saudi Arabia, Kuwait, Qatar, Iran, and Iraq); followed by certain parts of the former Soviet Union; the United States and Canada; and a few other countries around the globe, such as Venezuela, Libya, Norway, and Nigeria.

The Origin of Coal

Coal consists of solid bits and pieces of undecayed plant material, mainly organic matter. Most often, it forms when large amounts of dead plants collect in a swampy setting, and instead of decaying, they are buried by sands and muds, and eventually compressed into coal.4 Coal is typically concentrated in individual layers (coal seams) interbedded with other sedimentary rocks, although it can be widely dispersed as well. Coal exists in several different forms, called ranks.

The peak of global discovery of major oil fields occurred over 40 years ago, and there have been no giant oil fields found since.

Peat (used for heating and to produce the distinct, smoky flavor in whisky) is not yet coal, even though it consists largely of unconsolidated, undecayed plant remains. It contains 60 percent carbon along with abundant gases and moisture. The lowest rank of coal is brown coal (lignite), with roughly 70 percent carbon and a considerable moisture and volatile content. Soft coal (bituminous coal) contains 80–90 percent carbon, and much of the moisture and many of the gases have been removed from the parent organic material by compaction. Finally, hard coal (anthracite) contains little moisture or gases and is 90–100 percent carbon.

Carbon content and combustibility increase with rank. Higher-ranked coals are more valuable fuels because they generate more heat per mass consumed. The economic value of coal is also affected by the content of potential pollutants. Unfortunately, many high-carbon anthracite and bituminous coals of eastern North America are also rich in sulfur, which produces acid rain.

The main coal-producing regions of the U.S. are in the northern Appalachians (especially in Pennsylvania, West Virginia, Ohio, and Kentucky).5 These coal deposits have mostly been turned into anthracite by the high temperatures and pressures of the mountain building that created the Appalachians 330 million years ago. Unfortunately, this coal is also high in sulfur. There is also significant coal in the Illinois Basin, although that resource is mostly high-sulfur bituminous coal, so its mining has ceased. The main coal deposits currently exploited are the shallow lignites of the Powder River Basin in northeast Wyoming, which yield giant coal seams that are many meters thick, and not buried very deeply, making them relatively cheap to mine. These are extracted by huge strip mines and shipped by rail all over the country. Although this coal is low in sulfur (making it preferable to other sources), it is only lignite coal, so a lot more of it is required to produce the same amount of energy.

Trends in Oil and Coal Consumption

How long is the global supply of oil going to last? This question was best addressed by an oil geologist named M. King Hubbert back in 1956. A remarkably brilliant and innovative geologist and geophysicist, he spent his career in the oil business (Shell Oil), several government jobs (U.S. Geological Survey), and also in university professor posts. Hubbert made many contributions which led to much greater success in finding oil. Given his track record, geologists had good reason to take his ideas seriously.

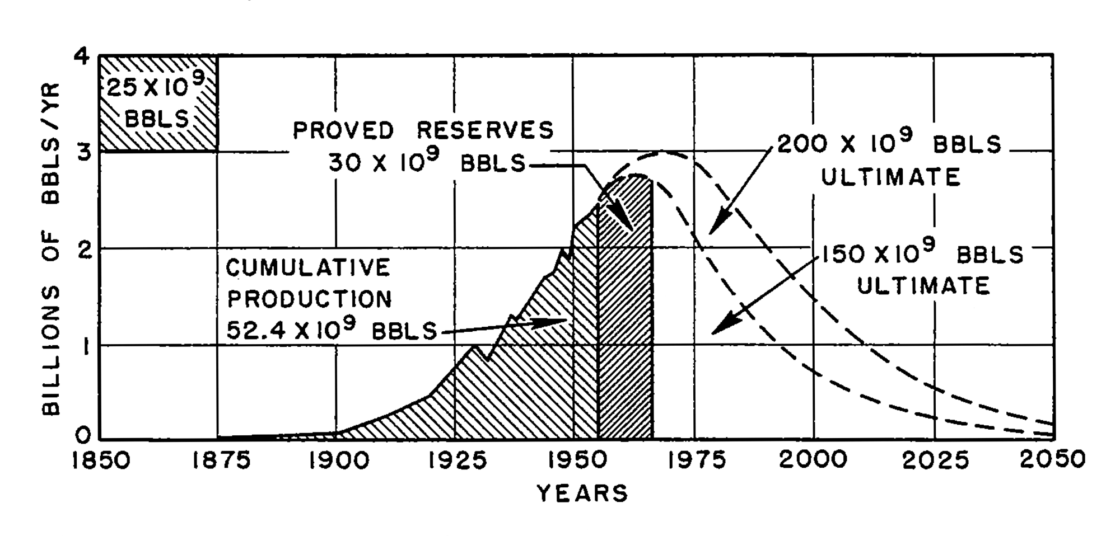

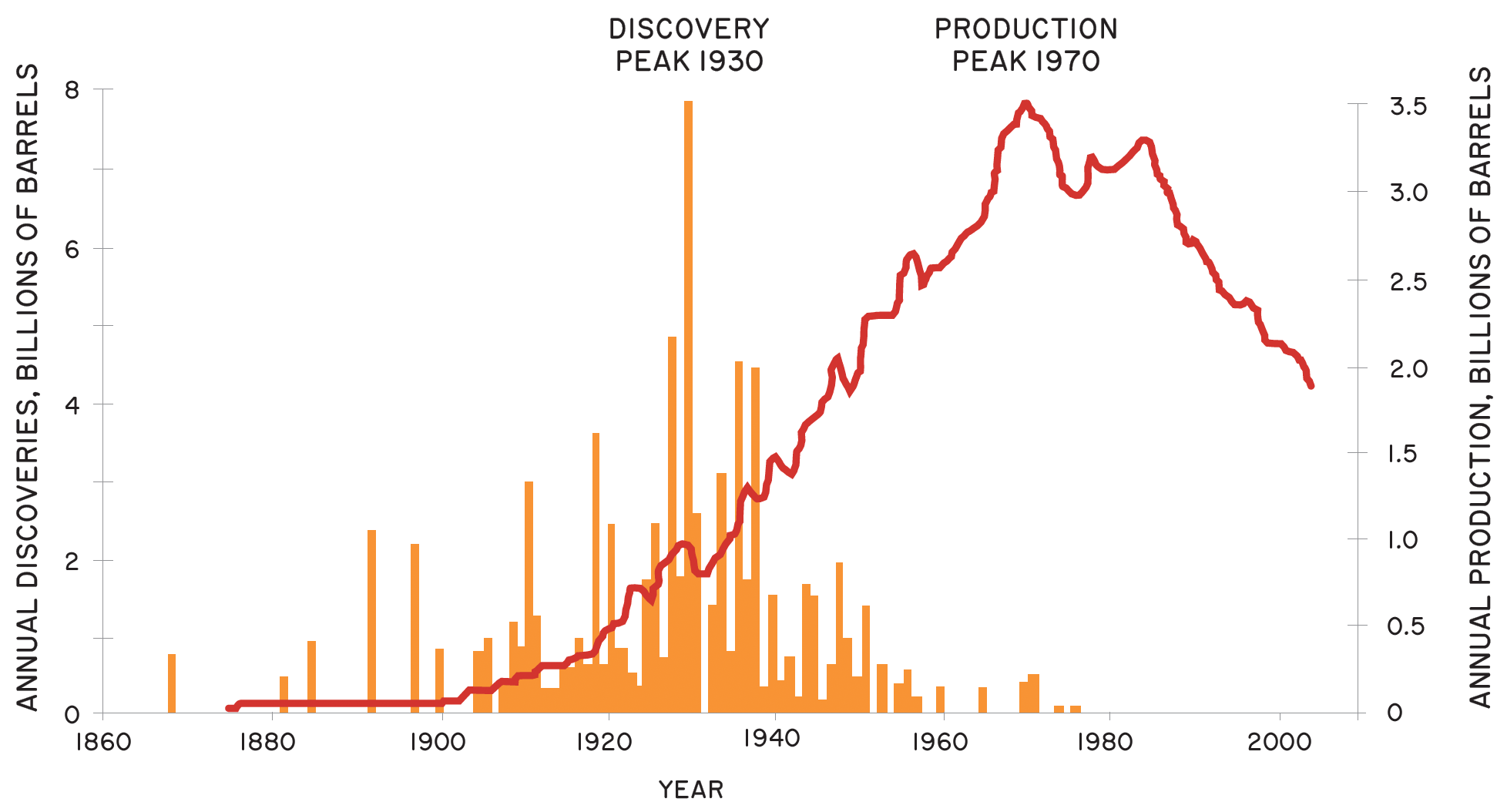

What was Hubbert’s prediction, and why was it so startling? While working for Shell, Hubbert gave a presentation at the 1956 American Association of Petroleum Geologists meeting at which he suggested that oil production should follow a bell-shaped curve, from slow growth at the beginning, to exponential growth to a peak, then a steady decline afterwards (Figure 1, top of page). He made the prediction that U.S. oil resources would peak between 1965 and 1971, depending upon which figure you used for oil reserves.6 Hubbert lived long enough to see that U.S. oil production had clearly peaked in 1970, and has been steadily declining since then (Figure 2). Although his ideas were rejected in oil company circles, they have long been accepted by academic geologists with no commercial interest to defend, and are now considered more and more realistic, even by oil companies.

Figure 2. The actual history of oil production in the U.S., which followed Hubbert’s prediction with remarkable consistency. This plot also shows the peak in U.S. discoveries in the 1930s, and how the peak of production occurred about 40 years later.

The end of “cheap oil” will happen soon but we will probably not realize it until oil-producing countries can no longer keep up with demand, no matter how high price rises.

How did Hubbert get the idea that oil production should follow a bell-shaped curve? Economic geologists had long known that this is the normal pattern seen in about any non-renewable mineral resource, such as oil, gas, coal, uranium, or any of the metals. Early in its history, a resource is consumed slowly, since it does not have a lot of established markets. Then a market develops, and suddenly the resource is produced and consumed at an exponentially increasing rate as the easiest-to-reach deposits are quickly mined or drilled. This exponential growth curve cannot last forever, and the production slows down as most of the easily reached deposits become exhausted. The market for the resource, however, continues to put high demand and even higher prices on the resource, even though only low-quality deposits remain. Exploration for less and less desirable deposits occurs in an attempt to extract even the most expensively obtained, lowest-grade resources that are left. Sooner or later, even these poor lowgrade deposits cannot keep up with demand, and production declines rapidly as there are no more new discoveries. The supply eventually runs out, no matter how much prices rise and demand increases. Then there is an abrupt economic adjustment as the mineral resource can no longer be found at any price, and people learn to do without it.

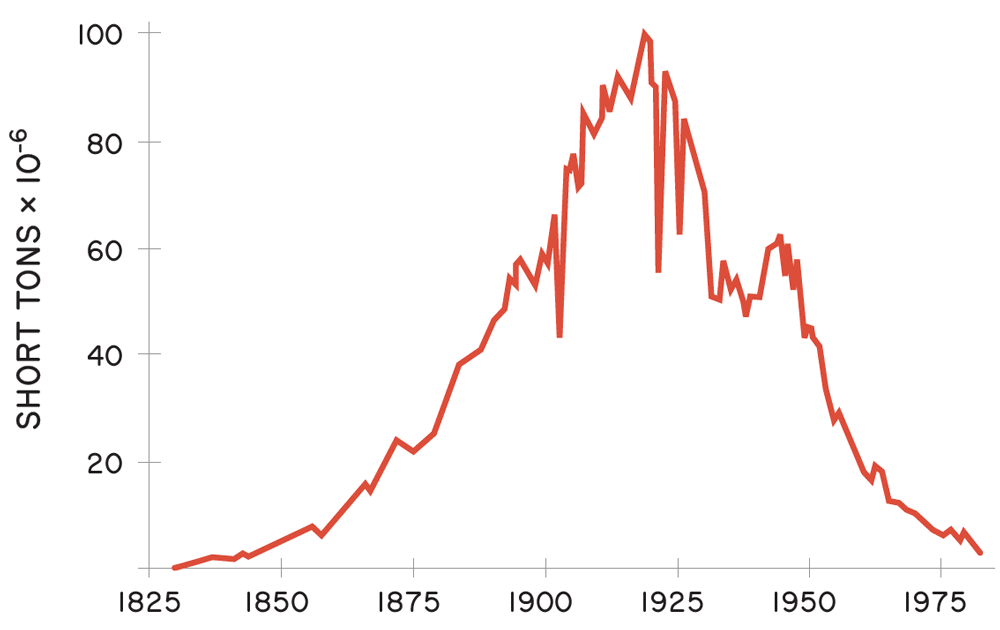

Figure 3. The history of production of anthracite coal in Pennsylvania, a classic example of the bell-shaped production of a non-renewable resource that goes from rapid mining to peak production to total exhaustion.

We can see this with the production history of anthracite coal from Pennsylvania (Figure 3) or many other resources.7 The demand for coal increased rapidly in the late nineteenth century as the Industrial Revolution and the development of steel created demand for coal-fired furnaces in western Pennsylvania. However, the dangerous job of mining these coal deposits in deep, easily collapsed shafts hundreds of feet below mountains meant that the good deposits were exhausted by the 1920s, and production has been declining ever since. There hasn’t been any significant coal production in Pennsylvania in over 35 years, even though the legends of Pennsylvania coalfields are still part of our culture. Mining companies shifted to other states with more abundant and easily mined coal.

Some people ask: what about supply and demand? It is true that over the short term, you see price fluctuations due to small changes in the supply-demand balance. In the case of coal, there were major downward spikes during World Wars I and II and the Great Depression, as wars and economic slowdown decreased or disrupted demand and production. There were also peaks during the post-war boom times of the 1920s and 1940s–1950s. However, these were just short-term blips on a long-term trend. Supply and demand only works when the supply is elastic; that is, you can always make or grow more of it if the price is high enough. Non-renewable mineral resources are inelastic: they cannot, over the long term, increase their supply. There was only a limited amount of them in the Earth’s crust to begin with, the minerals are no longer being generated at any significant rate by the Earth, and when they are exhausted, you just can’t make more.8

The Future of Fossil Fuels

It is now well established that the long-term use of fossil fuels is the major source of rising atmospheric carbon dioxide, the major driver of human-induced climate change and global warming. All scientific organizations that deal with the subject agree9 that we must scale back our use of carbon-based fuels and eventually eliminate them almost completely if we have any chance of saving the planet from the negative effects of climate change. The debate and discussion are now about how to go about this, which green energy sources should play a major role in the future, and how we wean ourselves off carbon-based fuels in the meanwhile.

By far the worst polluter among fossil fuels is coal, which releases more carbon dioxide per ton than oil or natural gas (coal alone makes up over 40 percent of carbon dioxide from all sources), and also releases methane, a much more potent greenhouse gas than carbon dioxide.10 It also has other extremely negative environmental effects, from strip mining of whole mountains, to the pollution of waterways with mine waste and the air with coal fly ash, to the long-term health of coal miners. Fortunately, coal mining is rapidly vanishing from the global economy, not due to excessive government regulation, but due to capitalism and free market forces: natural gas and solar have become much cheaper than coal.

As described, Hubbert’s “peak oil,” the global peak of coal consumption worldwide, already happened in 2013. The global peak in coal’s contribution to the energy mix was in 2008, when it accounted for 30 percent of global energy production. Both demand and production have been declining rapidly ever since. Coal mining is now virtually extinct in Great Britain, the birthplace of the coal industry. A clear sign of the times is the bankruptcy of many big American coal mining firms such as Peabody Energy, Murray Energy, Cloud Peak, and 11 other companies in recent years as coal cannot compete with the low prices of solar and natural gas.

The only countries that still mine significant coal are China (46 percent of the world’s production), India (9.5 percent of the world’s production), with minor amounts (less than 10 percent) from Indonesia, Turkey, Australia, followed by the remnants of the U.S. coal industry. However, both China and India are committed to scaling back and effectively phasing out their coal consumption, so coal is on the way out worldwide as a fuel source—and also as a polluter. Phasing out coal was one of the primary goals of the Paris Climate Accords in 2016, and of the COP26 agreement in Glasgow in 2021. Although China built a few new coal-fired power plants in 2020, globally, more coal power was retired than built. The U.N. Secretary General said that countries should stop generating electricity from coal by 2030, and many countries are on target to meet that goal. The end of using coal as a source of energy is in sight.

The situation for phasing out oil and natural gas is much more complicated. Many of us forget (or do not realize) that we use oil in many other ways besides energy. Nearly every synthetic substance we use, from the huge array of plastics to all the fabrics (nylon, rayon, Dacron, polyester, and many others) are produced from cheap oil. Many of your clothes are likely made from these synthetic fabrics, and nearly every object in a typical room has plastic in it. When oil becomes too expensive for these things, what will we do? Suddenly, we will no longer be able to import thousands of cheap plastic toys for our kids, or wear polyester or spandex clothes, or use products made largely of plastic, like the computer parts I’m using to write this article, or drink water and soda from plastic water bottles. When cheap oil becomes expensive, plastics will have to be recycled and rationed, and become much too precious for most of the ways we use and waste them today. And you can’t make plastics cheaply from anything but oil. Not from coal or anything else.

Then there’s another huge consumer of oil—agriculture, especially fertilizers, herbicides, and pesticides. All these products are derived from oil. An acre of corn consumes 80 gallons of oil in the form of pesticides, fertilizers, herbicides, and fuel for the tractors. We’ve replaced the human and animal labor of a century ago with machinery that requires lots of cheap oil. Our entire modern agricultural system of monoculture crops that have no resistance to pests, and which deplete the soil rapidly, can only be sustained by throwing oil at it in the form of herbicides, pesticides, and fertilizers. Without it, our food supply would collapse, and the world would be looking at a global famine. The end of cheap oil will force everyone to re-examine agricultural practices.

So, when is the global oil peak of Hubbert’s curve going to happen? Various authorities have pegged it at different times, from the early 2000s (so it might have already happened) to the 2020s and later (so it’s happening or is about to happen).11 It will be extremely hard to detect because the short-term “noise” and fluctuations in oil price and production make it difficult to see the overall trend until it is long past us. The “noise” of the short-term cycles of boom and bust in the price of oil makes it difficult for anyone to see a long-term trend that takes decades to fully develop and peak. At any given time, the price might become high and the oil become scarce, thanks to the power that Saudi Arabia, with the largest reserves in the world, can wield. From 2010–2014, Saudi Arabia cut their exports to drive up the price. Then in 2014, they rapidly increased production12 to drive down the price and punish Russia, and drive small U.S. companies out of business. However, during the global recession of 2008, the price of oil dropped due to the economic slowdown and again, during the COVID-19 economic slowdown of 2020–2021, the price of oil plummeted due to lack of demand. Most people only sense these short-term fluctuations due to specific events, but cannot see the bigger “signal” of the overall trend in oil production through all the short-term “noise.”

This article appeared in Skeptic magazine 28.2

Buy print edition

Buy digital edition

Subscribe to print edition

Subscribe to digital edition

Download our app

A more reliable measure of when the peak has occurred is obtained by plotting when the peak of oil discoveries occurred globally and noting that the peak of production will follow about 30–40 years later. This is vividly demonstrated by the history of U.S. oil discovery and production (Figure 2), when the peak of discovery occurred in the 1930s and the peak of production occurred in the 1970s, about 40 years later. The bad news is that global oil discoveries peaked in the early 1960s, and have been declining since, even while the price and demand for oil is near record highs. The idea that cheap, abundant oil will soon become scarce is well-documented and supported by existing data. The fact that Hubbert’s hypothesis exactly predicted the U.S. oil peak (Figure 2),13 and seems to be predicting the global peak, should be strong enough evidence in and of itself. There is also the fact that the peak of global discovery of major oil fields occurred over 40 years ago, and there have been no giant oil fields found since then (nor do most oil geologists think there are more to be found). Most of the world’s older oil fields are nearing exhaustion.

The end of “cheap oil” will happen soon but we will probably not realize it until oil-producing countries can no longer keep up with demand, no matter how high the price rises. Hopefully, the world will have already begun to phase out the use of oil and natural gas to reduce greenhouse gas emissions. If we don’t, the climate effects will be even more severe, and oil itself will start to get very expensive and too precious to waste on any but the most essential uses. ![]()

About the Author

Donald Prothero taught college geology and paleontology for 35 years, at Caltech, Columbia, and Occidental, Knox, Vassar, Glendale, Mt. San Antonio, and Pierce Colleges. He earned his PhD (1982) in geological sciences from Columbia University. He is the author of over 40 books (including six leading geology textbooks, and several trade books), and over 300 scientific papers, mostly on the evolution of fossil mammals (especially rhinos, camels, and horses) and on using the Earth’s magnetic field changes to date fossil-bearing strata.

References

- Prothero, D. R., & Schwab, F. (2013). Sedimentary Geology (3rd ed.). W.H. Freeman. p. 286.

- Ibid., p. 288.

- Ibid., p. 293.

- Ibid., p. 283.

- Ibid., p. 286.

- Hubbert, M.K. (1956). Nuclear Energy and Fossil Fuels. In Drilling and Production Practice, American Petroleum Institute & Shell Development Co. Publication No. 95, 9–22.

- https://bit.ly/3MI6H90

- Prothero, D.R. (2013). Reality Check: How Science Deniers Threaten Our Future. Indiana University Press. p. 227.

- https://go.nasa.gov/3GVy382

- https://bit.ly/3Ld2Pf5

- Deffeyes, K. (2001). Hubbert’s Peak: The Impending World Oil Shortage. Princeton University Press. p. 285.

- https://bit.ly/3AgboPG

- Deffeyes, K. (2001)

This article was published on September 15, 2023.